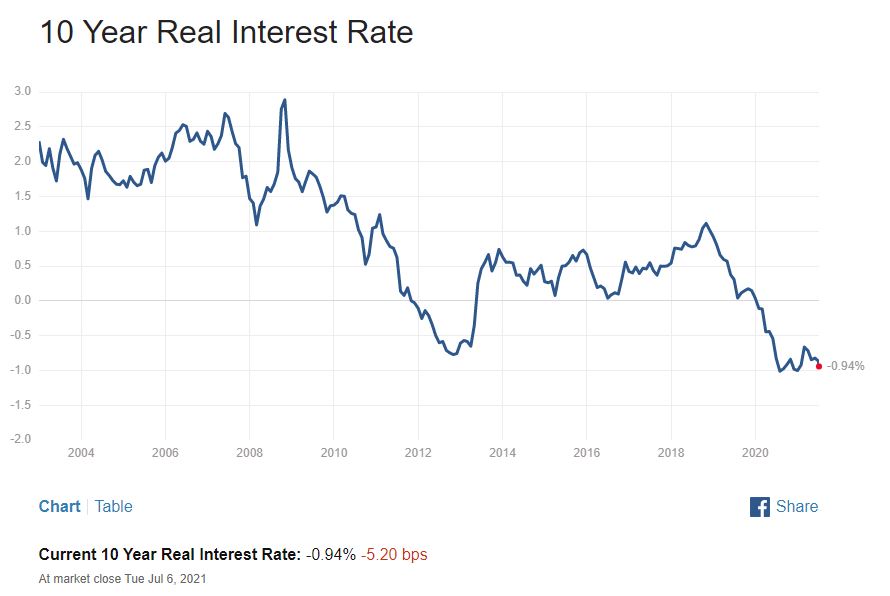

Digital retail behemoth Amazon will reportedly accept BTC as payment by the end of 2021. The possibility of a native token also seems to be on the cards. A job posting on Amazon’s website has sparked speculation of a big move into the crypto space.

Update July 28: Amazon have dismissed the rumours stating: “Notwithstanding our interest in the space, the speculation that has ensued around our specific plans for cryptocurrencies is not true … We remain focused on exploring what this could look like for customers shopping on Amazon.”

According to reports from an Amazon insider, the company will “definitely” be accepting BTC as payment by the end of this year with the possibility of a native token existing.

Amazon posted a job advertisement over the weekend for a “Digital Currency and Blockchain Product Lead” and wants someone who can “innovate within payments and financial system” to head up this position.

Not the First Time Amazon Has Advertised in the Crypto Field

The ad confirms recent speculation that the company will move to accept BTC and other cryptocurrencies as payment methods. An insider spoke to London business news publication City A.M. and gave a brief outline of Amazon’s plans for integrating crypto and blockchain technology.

This is not the first time that Amazon has posted a job offer in the crypto field. Twitter was abuzz with the news and this tongue in cheek job application stood out from the crowd.

According to the insider, Amazon will accept BTC payments by the end of 2021 and is not just going through the motions to set up crypto payments. The plan is an integral part of how Amazon will operate in the future.

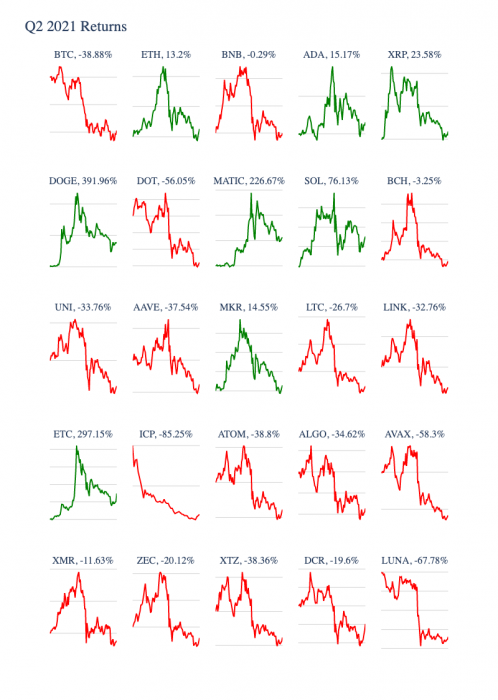

Plans to move into crypto will start with BTC, but the company is keen to add other big cryptocurrencies once secure and fast methods of BTC payment have been established.

Should all go well with BTC, the company will then move on to accept Ethereum, Cardano, and BTC Cash before then bringing on about eight more of the world’s most popular cryptocurrencies.

The plan for adopting crypto reportedly comes from the very top of Amazon, Bezos himself.

Amazon Set to Launch Its Own Token

The involvement of a gigantic player such as Amazon will likely drive up the price of BTC and other larger alt coins. And Amazon’s plans for crypto do not stop here. It is reported that when all proposed crypto plans are integrated, the final move will be to create its own native token, reportedly by 2022.

The insider reported that after a year of experiencing crypto as a payment method, a move to tokenisation will take place.

This then becomes a multi-level infrastructure where you can pay for goods and services or earn tokens in a loyalty scheme. There’s little more to it, for now, but you can guarantee the Bitcoin plan will be monitored closely as opportunities with Amazon’s own version of a crypto will be explored.

Amazon insider

By Jana Serfontein, Crypto News Guest Author