Embattled crypto lender BlockFi has signed a deal with FTX US, the American arm of Sam Bankman-Fried’s crypto exchange, which will see FTX increase its credit facility to BlockFi with an option for FTX to acquire the struggling lender.

In an extensive Twitter thread, BlockFi co-founder Zac Prince explained the deal was valued at up to US$680 million, including a US$400 million revolving credit facility and the option for FTX to acquire BlockFi for up to US$240 million. According to Prince, as of July 2 the deal was still subject to shareholder approval.

BlockFi Hits Choppy Financial Waters

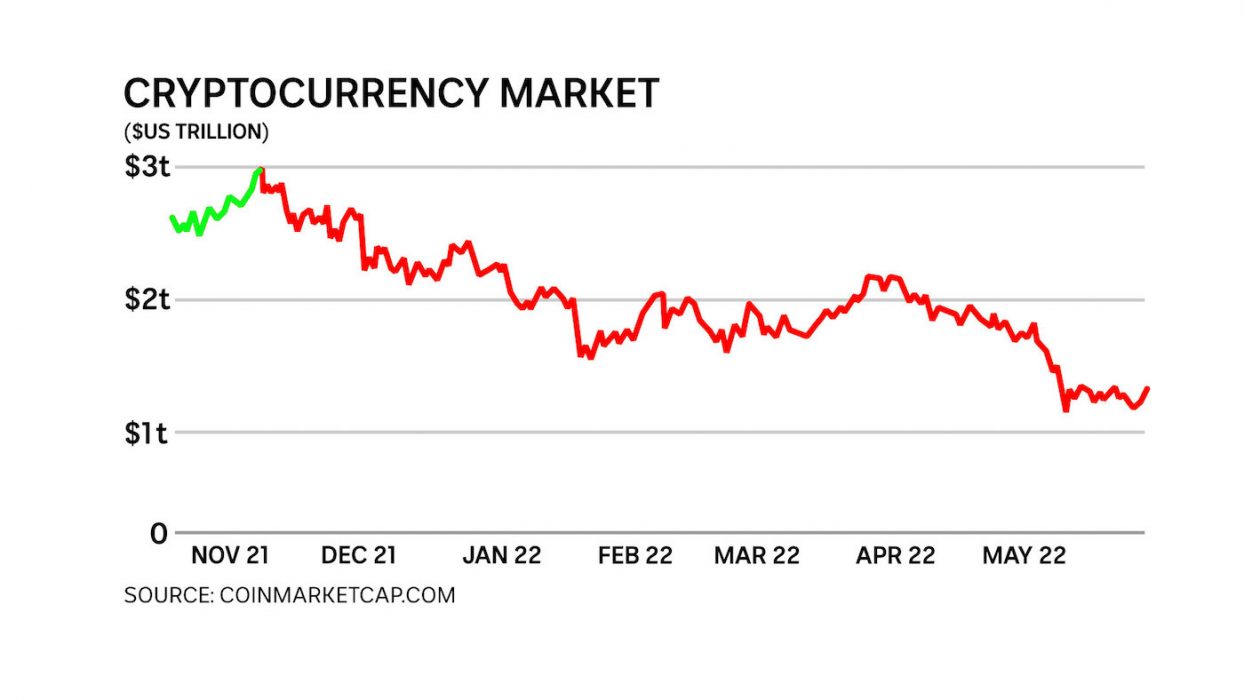

BlockFi started to experience financial strain following the May collapse of the Terra blockchain and the subsequent bankruptcy of the highly LUNA-exposed Three Arrows Capital, to whom BlockFi had made sizeable loans.

These events – combined with the recent aversion to centralised lenders sparked by Celsius’ liquidity crisis, and the general market decline – have tested BlockFi’s resilience and forced the lender to shed around 20 percent of its workforce, approximately 170 employees.

In June, FTX extended a US$250 million line of credit to BlockFi to help the lender secure client funds. With this new deal, the credit facility has been extended to US$400 million.

According to Prince, BlockFi has not yet had to draw on the available credit, and the CEO insists the lender is still financially strong despite securing an increased line of credit and agreeing to a sale price far lower than its most recent valuation of US$1 billion:

We have not drawn on this credit facility to date and have continued to operate all our products and services normally. In fact, we raised interest rates, effective today.

Zac Prince, co-founder and CEO, BlockFi

Deal Protects Client Funds

Prince said the deal was primarily about ensuring BlockFi could protect client funds and that FTX was the ideal partner as it shares the same client-first values:

“As a matter of principle, we fundamentally believe in protecting client funds,” Prince tweeted. “Not only because it’s absolutely the right thing to do, but this also benefits the ongoing health and adoption of crypto financial services worldwide. Therefore, it was important to add capital to our balance sheet to bolster liquidity and protect client funds.”

We were presented with various unattractive options where client funds would take a haircut or be behind a lender in the capital stack … Ultimately, we found a great partner in @FTX_US, who shares our commitment to clients. This represents the best path forward for all @BlockFi stakeholders and the crypto ecosystem as a whole.

Zac Prince, co-founder and CEO, BlockFi

According to Prince, the terms of the deal make repayments to FTX subordinate to protecting client funds, which means if the worst were to happen, and BlockFi couldn’t pay all its bills, priority would be given to cashing out clients.

Not Everyone Is Convinced

BlockFi’s claims of financial strength have been widely questioned on Twitter, with many users wondering why a company in a supposedly strong position would seek an increased line of credit and accept an option to acquire it for a fraction of its valuation:

This doesn’t add up though.

— Rahul Rai (@rahul_rai121) July 1, 2022

If you’re not insolvent, then why would you need the $400M revolving credit line?

And why would you consider selling at 1/10th of your latest round’s valuation?

If BlockFi is doing so well, why are you selling it for pennies on the dollar?

— Fintwit (@fintwit_news) July 1, 2022