Let’s take a closer look at today’s altcoins showing breakout signals. We’ll explain what the coin is, then dive into the trading charts and provide some analysis to help you decide.

1. Ripple (XRP)

Ripple XRP is the currency that runs on a digital payment platform called RippleNet, which is on top of a distributed ledger database called XRP Ledger. While RippleNet is run by a company called Ripple, the XRP Ledger is open-source and is not based on blockchain, but rather the previously mentioned distributed ledger database.

XRP Price Analysis

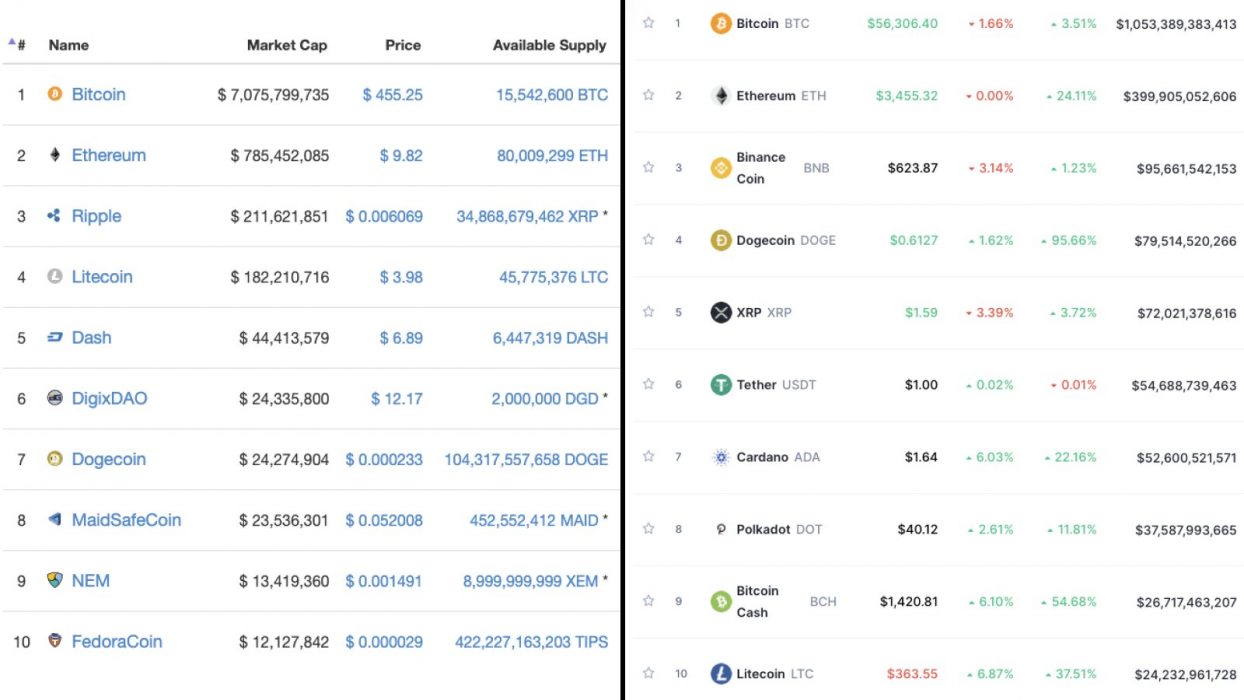

At the time of writing, XRP is ranked the 6th cryptocurrency globally and the current price is A$1.59. Let’s take a look at the chart below for price analysis:

After retracing nearly 68% from its highs, XRP has wicked into the monthly gap beginning near A$1.32. This wick formed the bottom of the current range.

The price shows no apparent signs of a longer-term reversal, which may mean that the closest resistance near A$1.85 will continue to suppress the price. However, some support could be found near the monthly open, possibly giving bulls footing for a stop run through the swing high at A$1.66.

This move could continue into resistance near A$1.71 and spike through the relatively equal highs near A$1.77. A break of the next swing high near A$1.83 is likely to find resistance once it reaches A$1.90. If this move occurs, it may suggest a longer-term reversal.

A retest of possible support near A$1.46 could provide an entry for a short-term trade. However, there is a higher probability for more substantial support near A$1.40 after a run on the lows at A$1.37 and A$1.30.

2. Litecoin (LTC)

Litecoin LTC is a cryptocurrency that was designed to provide fast, secure and low-cost payments by leveraging the unique properties of blockchain technology. The cryptocurrency was created based on the Bitcoin protocol, but it differs in terms of the hashing algorithm used, hard cap, block transaction times and a few other factors. Litecoin has a block time of just 2.5 minutes and extremely low transaction fees, making it suitable for micro-transactions and point-of-sale payments.

LTC Price Analysis

At the time of writing, LTC is ranked the 15th cryptocurrency globally and the current price is A$243.57. Let’s take a look at the chart below for price analysis:

LTC has dropped nearly 75% from its highs, with the current low’s wick on July 21 taking stops below two major swing lows.

The resulting bounce found resistance near A$310.08, which could continue to cap upward movement. If the price finds support in the current region near A$236.17, it could continue to resistance just above the relatively equal highs near A$257.83. A more substantial move might run stops above the swing high near A$265.10 into resistance near A$270.92.

A break below the monthly open is likely to target buy stops near A$230.46, an area that could provide some support. A move below this level could target below the swing low at A$214.88, possibly reaching the gap beginning near A$203.55.

3. Eos (EOS)

EOS is a platform that’s designed to allow developers to build decentralised apps. The project’s goal is relatively simple: to make it as straightforward as possible for programmers to embrace blockchain technology and ensure that the network is easier to use than rivals. As a result, tools and a range of educational resources are provided to support developers who want to build functional apps quickly. EOS also aims to improve the experience for users and businesses. While the project tries to deliver greater security and less friction for consumers, it also vies to unlock flexibility and compliance for enterprises.

EOS Price Analysis

At the time of writing, EOS is ranked the 40th cryptocurrency globally and the current price is A$6.49. Let’s take a look at the chart below for price analysis:

EOS‘s nearly 83% drop from its May highs found a low near A$4.65 in July before closing over a short-term high around A$8.35 last month.

This daily close over the high could signal a shift in market structure that might reach probable resistance near A$7.36. A sustained bullish move may target the swing high at A$7.84. If this stop run occurs, a run beyond the high into probable resistance near A$8.15 and A$8.49 is possible.

Bulls could buy a retracement to possible support near A$5.82, just above the monthly open. A bearish turn in the marketplace may propel the price toward possible support near A$5.48.

However, relatively equal lows near A$5.30 and A$5.12 provide an attractive target for bears if the market resumes its bearish trend. A run on these lows might find support between A$4.95 and A$4.85.

Where to Buy or Trade Altcoins?

These coins have high liquidity on Binance Exchange, so that could help with trading on AUD/USDT/BTC pairs. And if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is an easy-to-use popular choice in Australia.