Solana’s momentum is strong as it gained almost 50 percent in the past week, hitting new all-time highs daily in a steady upward climb.

From US$30 just a month ago, Solana has now reached a top of US$114 and doesn’t seem to be slowing down any time soon. According to CoinGecko, Solana’s trading volume is currently at almost US$5 billion, with a market cap now just short of US$33 billion, coming for Dogecoin’s #7 spot, the meme coin with a current market cap of US$37 billion.

Solana Dubbed the ‘Ethereum Killer’

Solana solves the ‘Blockchain Trilemma’, which basically states that among the three factors of decentralisation, scalability and security, a blockchain network must sacrifice one to properly implement the other two. Solana has managed to find the answer to the issue of scalability without the need for layer-2 solutions.

Solana is a Proof of History (PoH) blockchain with much faster transaction speeds and lower transaction fees compared to Ethereum, currently the most popular smart contracts platform and blockchain of choice for the DeFi and NFT market. The Solana network boasts approximately 1,000 live transactions per second (with testnet numbers as high as 50,000 TPS).

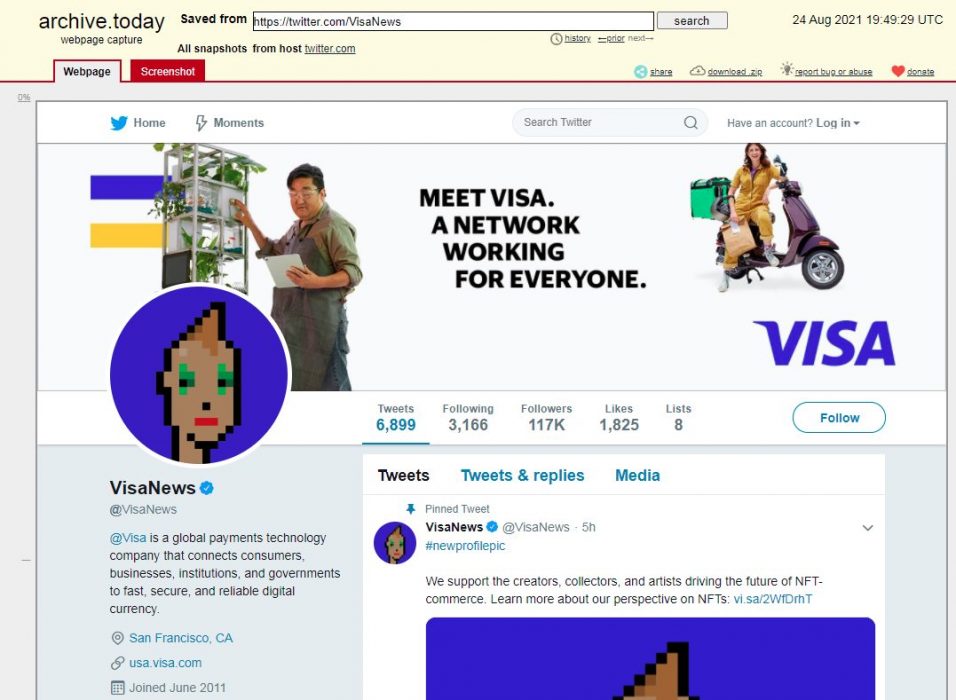

It could soon become the choice for many dApps that will choose to build on the Solana network instead of Ethereum, which has been widely criticised for its network congestion, high gas fees, and lack of scalability. Recently launched Solana-based DEX, Mango Markets brought bullish news for Solana, as did the Degenerate Ape Academy NFT drop, a project based on Solana’s NFT marketplace, Solanart.

Major companies using blockchain technology are also adapting to the Solana network, as per July’s announcement by Australian renewable energy trading platform Power Ledger that it would migrate from Ethereum to Solana.