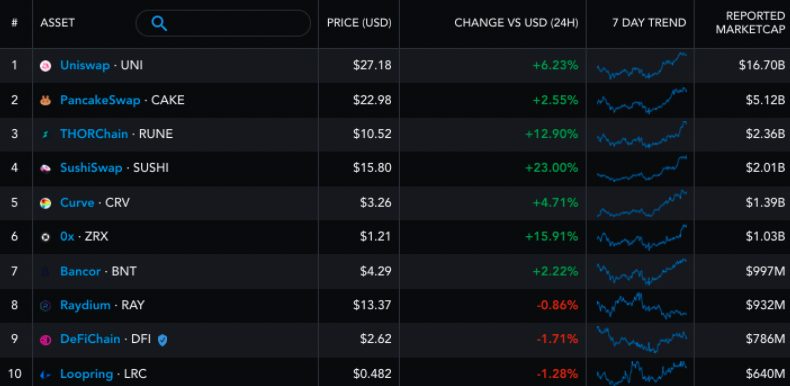

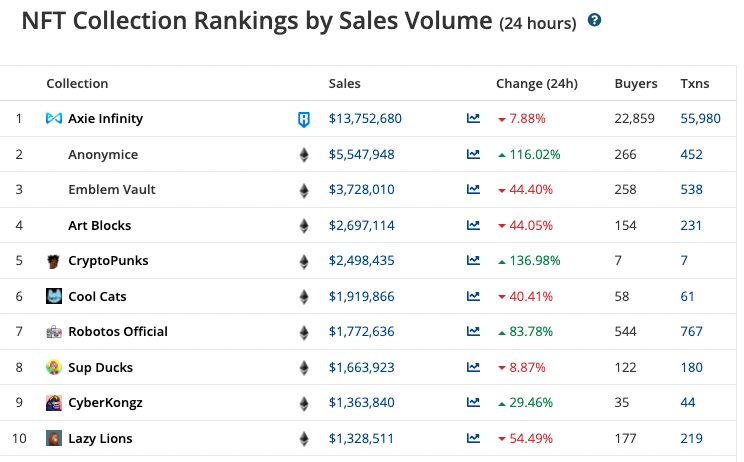

The non-fungible token (NFT) project Emblem Vault has soared 225 percent over the past month to become the second-largest NFT project by sales volume as reported by NFT data aggregator CryptoSlam.

What is Emblem Vault?

Launched by Emblem Finance on Bitcoin and Ethereum in September 2020, Emblem Vault is a tokenised multi-asset wallet that wraps crypto portfolios into a single NFT token.

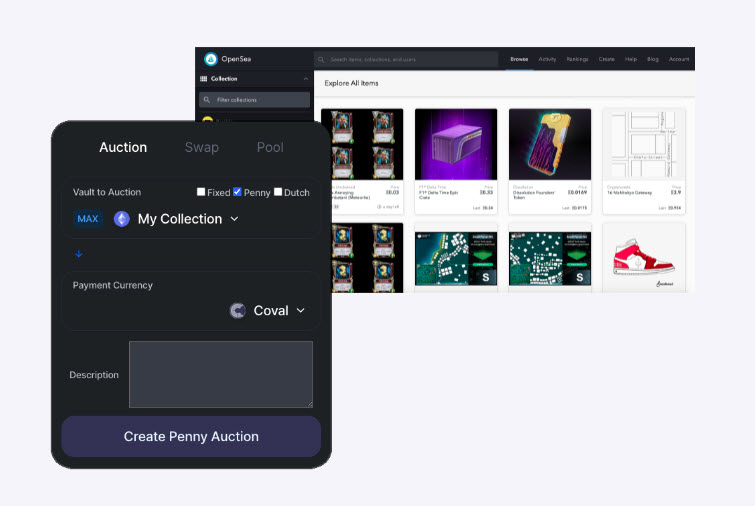

Each Emblem Vault is an Ethereum-based NFT that functions as a multi-asset wallet allowing users to move around and trade entire portfolios of NFTs and traditional cryptos, including those from other chains, as a single token.

Emblem wraps up tokens as modern ERC-721 NFTs. These are the same type of token trading on popular NFT marketplaces like OpenSea, though Emblem allows collectors to trade NFTs that predate the ERC-721 NFT standards.

NFT Boom Continues

Emblem Vault has gained traction as the NFT boom continues. Sales volumes have made immense gains as more people continue to discover the project, and collectors are seeking out OG NFTs.

Pepe the Frog, one of the classic NFTs, has appeared in Emblem Vault. A vintage RarePepe NFT that portrays a cartoon ‘Pepe’ of Satoshi Nakomoto sold for 144 ETH, worth around US$490,000 at the time. And EthPepe, a ‘Pepe’ portraying Ethereum co-founder Vitalik Buterin, sold for a whopping 100 Wrapped Ethereum (WETH), worth about US$300,000.

Emblem Vault still lags US$9.5 million behind the biggest NFT project, Axie Infinity. Yet the project is still US$4 million ahead of other NFT projects like Bored Ape Yacht Club, which sold a collection of NFTs for almost US$25 million earlier this month.