Luxury high-end international fashion brand Gucci is set to accept various cryptocurrencies including Bitcoin, Ether, and even Dogecoin in some of its stores in North America.

Gucci will start accepting cryptos in five of its stores across the US later this month. The locations are New York City (Wooster Street), Los Angeles (Rodeo Drive), Miami (Design District), Atlanta (Phipps Plaza), and Las Vegas (The Shops at Crystals).

The stores will accept include Bitcoin, Bitcoin Cash, Ethereum, Wrapped Bitcoin, Litecoin, Dogecoin, Shiba Inu, and five stablecoins that are pegged to the US dollar.

Crypto Provides an ‘Enhanced Customer Experience’

According to Marco Bizzarri, president and CEO of Gucci, the brand is “always looking to embrace new technologies when they can provide an enhanced experience for our customers”. He added:

Now that we are able to integrate cryptocurrencies within our payment system, it is a natural evolution for those customers who would like to have this option available to them.

Marco Bizzarri, president and CEO, Gucci

Gucci has been active in the Web3 and NFT space and recently established a Web3-focused team and released a couple of NFTs. The brand is also extending its crypto efforts to the metaverse where it is developing digital real estate in the decentralised blockchain game The Sandbox. Further, Gucci is building a virtual “Gucci Vault” for Gucci-themed NFTs.

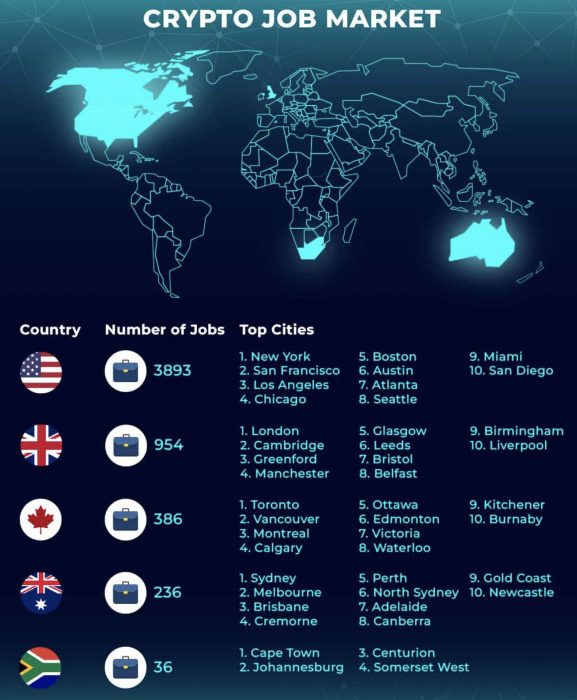

More and More Companies Accept Crypto Payments

Gucci joins a raft of companies that accept crypto as payment. Last year, Crypto News Australia reported that a real estate company in Los Angeles would allow its tenants to rent properties with Bitcoin, starting with the Grove shopping centre and other LA properties.

Many companies in Australia are also accepting cryptocurrencies as payments. You can now order a custom-built PC, buy dog food, design a custom home, get solar power and pay for almost everything in Bitcoin.