Australian airline Qantas is one of the newest major ASX-listed companies to include a non-fungible token (NFT) offering. The offering, however, has since seen considerable pushback from the community, citing environmental concerns with NFTs and other issues.

World First for Australian Airline

Qantas’s digital collection of memorabilia is a first for any airline to allow users to buy, sell, and collect NFTs and also enable buyers to earn Qantas Points. Holders might also have something extra to look forward to with Qantas stating, “exciting future benefits for Qantas NFT holders [are] under way”.

Chief customer officer Stephanie Tully said customers have been collecting physical Qantas memorabilia for years and NFTs would be the newest iteration. According to its post, the ‘Flying Kangaroo’ will allow cash transactions as well as crypto when it launches the NFT collection mid-year.

A Qantas NFT collection allows us to engage the next generation of aviation and digital art enthusiasts, leveraging blockchain technology to celebrate our heritage and future.

Stephanie Tully, chief customer officer, Qantas

Qantas Customers Take to Twitter

However, very few commentators on Twitter seemed to be as excited as Qantas about its new offering:

NFTs have become popularised as a way for audiences to have a new way of engaging with their favourite brands. On the other hand, some see them as a money grab scheme implemented by businesses to create a new revenue stream:

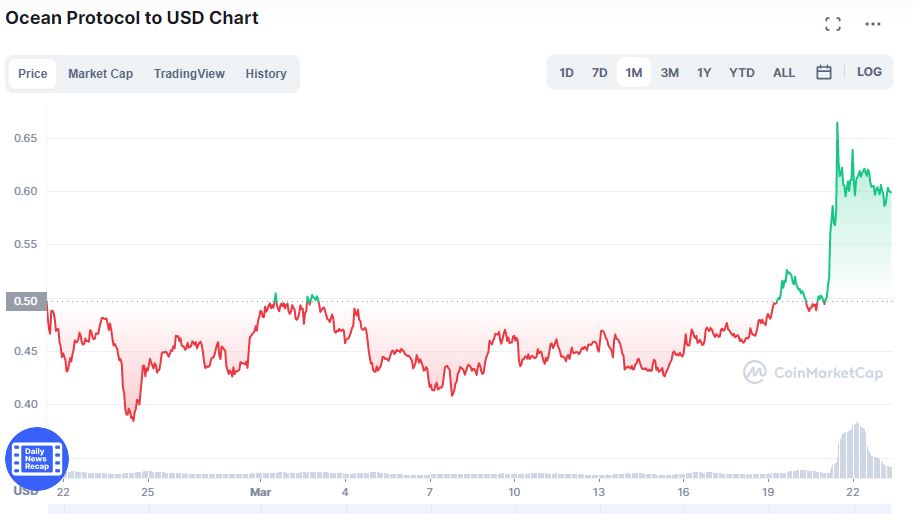

NFTs have boomed in the past year – according to Chainalysis, in 2021 a minimum of US$44.2 billion was sent to NFT contracts – though they have also come under fire for facilitating greater carbon emissions and running on unsustainable blockchains.

In February, Salesforce employees protested the company’s plan to implement the novel technology. And according to recent statements from WWF and Uber, Bitcoin and NFTs are both still too power-hungry and neither organisation will accept them until they’re greener.