Verdict: Is Swyftx any good?

Swyftx is one of the best options on the market for Australian cryptocurrency investors. The platform offers low trading fees (0.6%) and tight spreads, making it a cost-effective crypto exchange for buying, selling and trading digital currencies.

The crypto exchange’s streamlined design, support for recurring buys and live chat make it a comfortable choice for complete cryptocurrency novices.

More experienced users will enjoy a comprehensive earn hub, crypto bundles and a huge range of supported assets.

Advanced derivatives traders may want to look for an alternative exchange, as Swyftx does not offer futures, options or perpetual contracts.

Overview

| Website: | Swyftx.com/au/ |

| Headquartered: | Brisbane, Australia |

| Listed cryptocurrencies: | 310+ |

| Trading fees: | 0.6% |

| Fiat currencies: | AUD, NZD and USD |

| Deposit methods: | Bank transfer, PayID, POLi, Credit/Debit Card |

| Australian-based customer service: | Yes |

| Mobile app | Yes, iOS and Android |

What is Swyftx?

Swyftx is an Australian cryptocurrency exchange headquartered in Milton, Brisbane. The platform was founded in 2017 by Alex Harper and Angus Goldman and has since expanded to service customers from New Zealand. The company also has plans to support customers from the UK and Canada.

Users can buy, sell and trade over 310 crypto assets using the platform’s streamlined yet customisable user interface. The huge variety of digital assets on offer makes Swyftx an excellent choice for both beginner and more experienced investors.

Australian crypto exchanges can be notorious for high, undisclosed spreads, but Swyftx is renowned for its fee transparency. The trading fee is a flat 0.6%, with the possibility of discounts based on high trading volume, and spreads are easily visible

The platform supports a competitive earn hub, SMSF (Self-Managed Super Fund) support, advanced order options and a demo trading mode.

In its relatively short life, Swyftx has established itself as a reliable, cost-effective and secure exchange. Beginners and intermediate investors alike will find themselves at home using the platform, although advanced users wishing to trade derivatives will want to look elsewhere.

Pros and cons

| Pros | Cons |

| Competitive trading fees (0.6%) and transparent spreads, especially for an Australian exchange | Fees are a bit high for day-traders, compared to international trading platforms (like FTX or Binance) |

| Excellent reputation for security and trustworthiness | No advanced trading options like derivatives |

| Well-optimised and sleek mobile app | No insurance fund |

| Wide range of supported cryptocurrencies | |

| Helpful features like earning, SMSF support and tax report generation | |

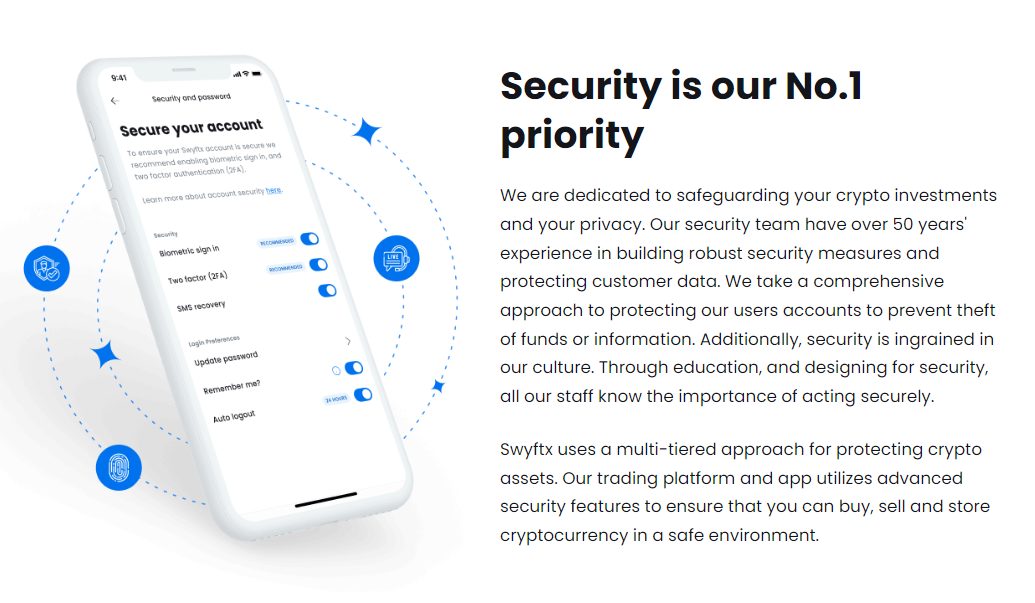

Is Swyftx safe?

Swyftx has built a reputation among the Australian community for being a trustworthy and safe exchange. In its 3+ years of operation, the platform has never reported a hack or other compromising event. Swyftx is registered with the Australian Transaction Reports and Analysis Centre (AUSTRAC) and abides by all Anti-Money Laundering (AML), Know Your Customer (KYC) and Counter-Terrorism Financing (CTF) laws.

The cryptocurrency exchange prioritises the safety of its customer’s assets and utilises a multi-tiered security approach. Swyftx uses industry-standard security measures such as Two-Factor Authentication (2FA), cold storage, penetration testing, data encryption and the least privilege principle. Swyftx also aims to become one of the very few Australian exchanges to receive ISO 27001 certification. This certification is regarded as the international benchmark for security management.

Swyftx does not currently offer an insurance fund for crypto assets and fiat currency held on the platform. This does not necessarily make Swyftx any less safe than alternatives — particularly given its sparklingly clean track record — but it is still worth keeping in mind.

Swyftx customer support

Swyftx has one of the best customer support services for Australians wanting to buy and sell crypto. The platform hosts a comprehensive Help Centre, filled with 100+ helpful articles that walk customers through depositing AUD, placing buy/sell orders or customising the dashboard.

If the Help Centre doesn’t answer the question, Swyftx offers a 24/7 live chat. The support team is Australia-based and responsive, with wait times usually ten to fifteen minutes during work hours.

Swyftx has a 4.7/5 star rating on TrustPilot (from 3,822 reviews) and a 4.6/5 star rating on ProductReview (from 3,686 reviews), demonstrating the team’s excellent customer service.

Swyftx fees

Australian crypto exchange platforms are generally a little costlier than international alternatives, but Swyftx’s competitive trading fees stack up well against its local and overseas competitors.

Overall, Digital Surge is the only Australian exchange that currently has cheaper combined transaction fees and spreads than Swyftx.

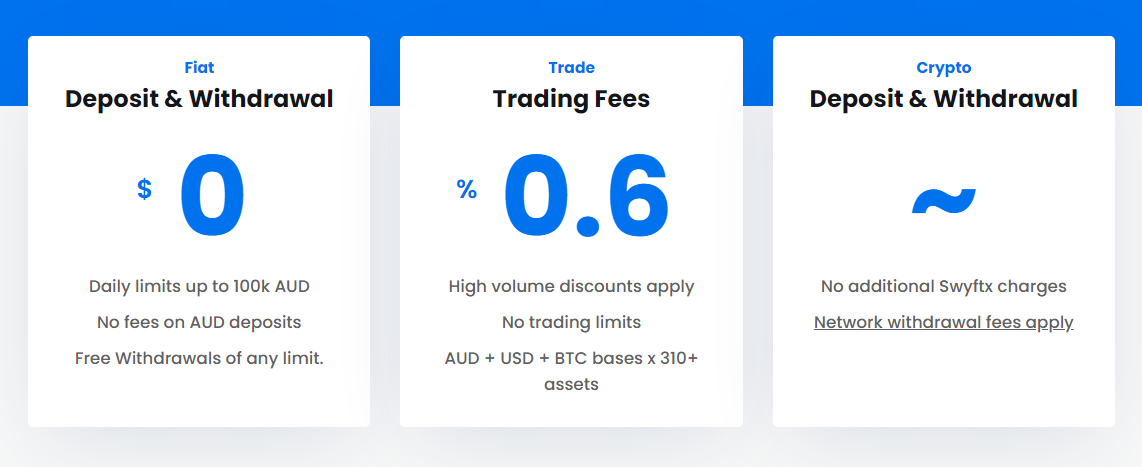

Trading fees

Swyftx charges a flat trading fee of 0.6% on all transactions. This includes buying and selling cryptocurrencies with AUD or swapping one coin for another.

Customers can expect around a 1% trading fee on average when using other Australian exchanges, making Swyftx quite cost-effective.

Deposit & withdrawal fees

Fiat

Swyftx does not charge any fees on AUD deposits and withdrawals from an Australian bank account. Free and near-instant fiat transactions are a great feature of the exchange.

The deposit and withdrawal limit for AUD is $50,000 per transaction, per day. However, both of these limits can be extended upon request.

Credit/debit card deposits will incur a 3.6% third-party processing fee from Banxa. The maximum card deposit is $60,000 per month.

Cryptocurrency

Swyftx does not charge any fees for sending or receiving cryptocurrencies to a wallet. However, standard network (gas) fees will apply.

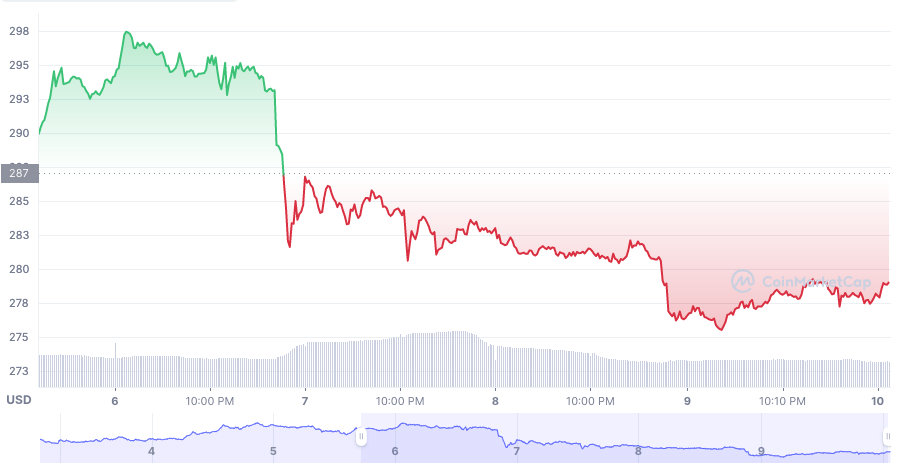

Spreads

Spreads are the difference in an asset’s price between the time an order is placed, and the time it is executed. Spreads are hidden fees that can make trades more expensive than they appear. Those new to trading may not know what spreads are and quickly become confused at the extra costs.

Swyftx hangs its hat on providing some of the tightest spreads in Australia. The platform is transparent with the spreads for each trade, with fees starting as low as 0.45%. The overall average spread of 1.7% is extremely competitive in the Australian market. Some customers have reported Swyftx’s competitors charging very high spreads of over 4%.

Swyftx features

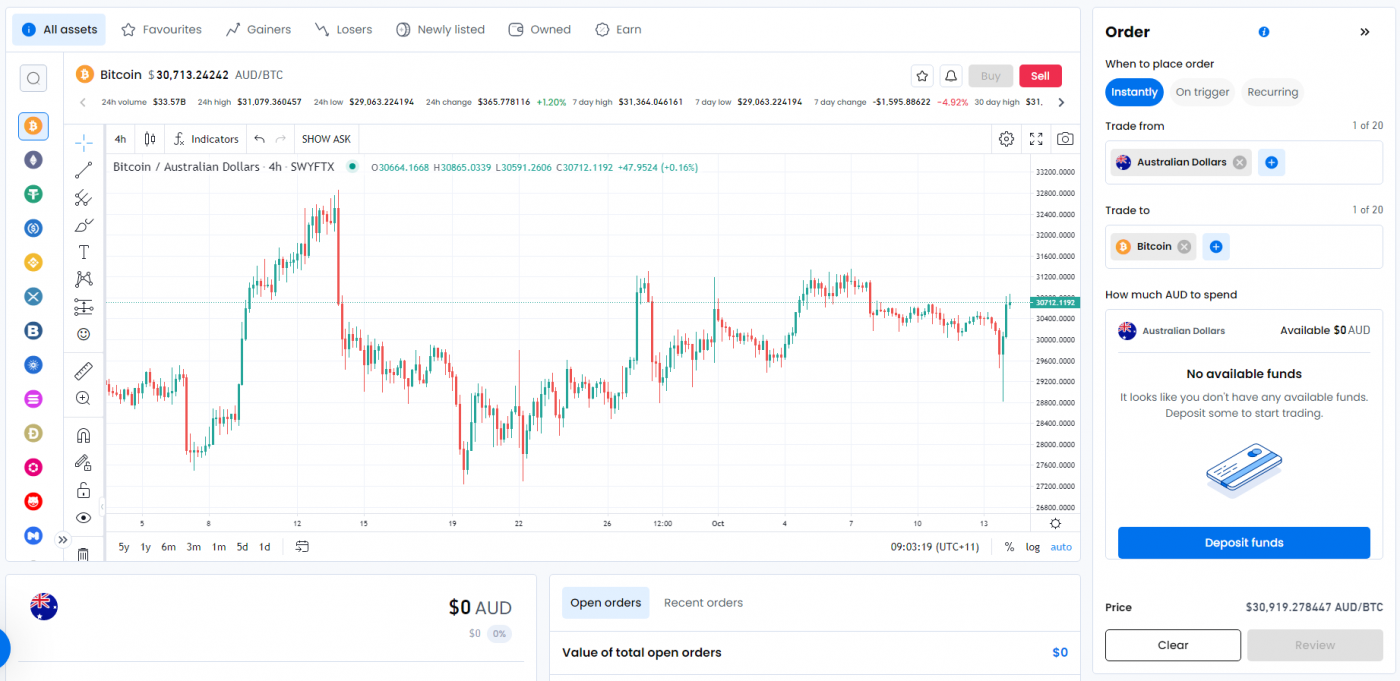

Trading on Swyftx

Swyftx’s trading interface is clean and easy to navigate. Beginners can easily build their portfolio by setting up instant orders for buying or selling cryptocurrency. Finding coins to purchase is easy — users can simply type the coin’s name into the search bar and click “Buy”. Alternatively, customers can sort through the 310+ digital currencies based on recent price movements or market cap.

More experienced traders can set up advanced orders that trigger when an asset hits a specific price (effectively a limit order). This can be used to potentially buy or sell cryptocurrencies at a preferred value, instead of at the current market rate. The Swyftx trading terminal also offers a customisable chart.

It’s worth mentioning that Swyftx lacks several features advanced traders might desire, such as derivatives, market depth and an order book.

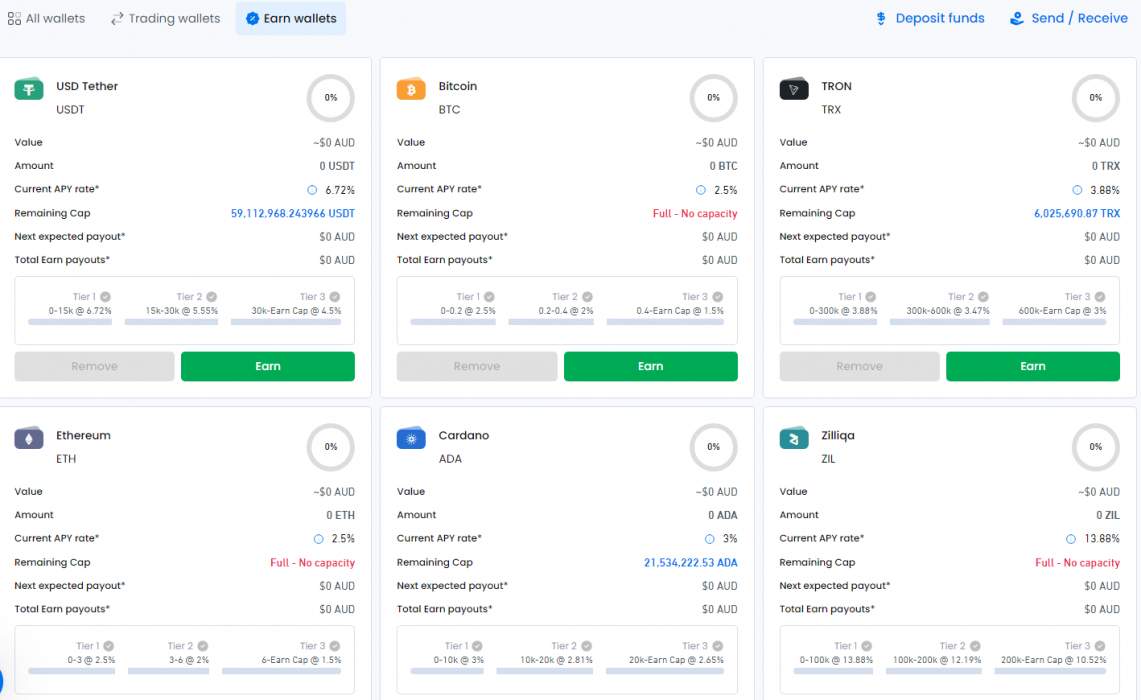

Earn

Swyftx supports earn wallets for 20 assets, where customers can lock up their tokens and passively earn returns of up to 65+%. Generally, the earning rates on offer are competitive for a centralized exchange. Although yields typically fluctuate, the APYs for assets like Kusama, Kava and Tron are above average. On the other hand, Ethereum and Solana have lower earning rates than if investors staked them on-chain.

Each asset is divided into three tiers, where the more cryptocurrency a customer locks up, the lower their earning rate. For example, someone staking less than 3 ETH could earn an APY of 2.5%. However, if they are staking more than 6 ETH, that APY drops to just 1.5%.

The Earn program works similarly to a high-interest savings account, where cryptocurrencies locked in an earn wallet are loaned to Swyftx without a minimum period. Swyftx then repays the “at-call” loan with interest.

There are no fees for depositing or withdrawing cryptocurrency from the Earn wallet. Some major digital currencies supported include Solana, Cardano, Ethereum, Cosmos and Polkadot.

In 2022, Swyftx removed four cryptocurrencies from their earn program — TrueAUD, USD Coin, USD Tether and Bitcoin — as a preventive method to ensure customer safety. Unfortunately, these cryptos are typically in high demand for passive earning, so some investors will need to find a suitable alternative.

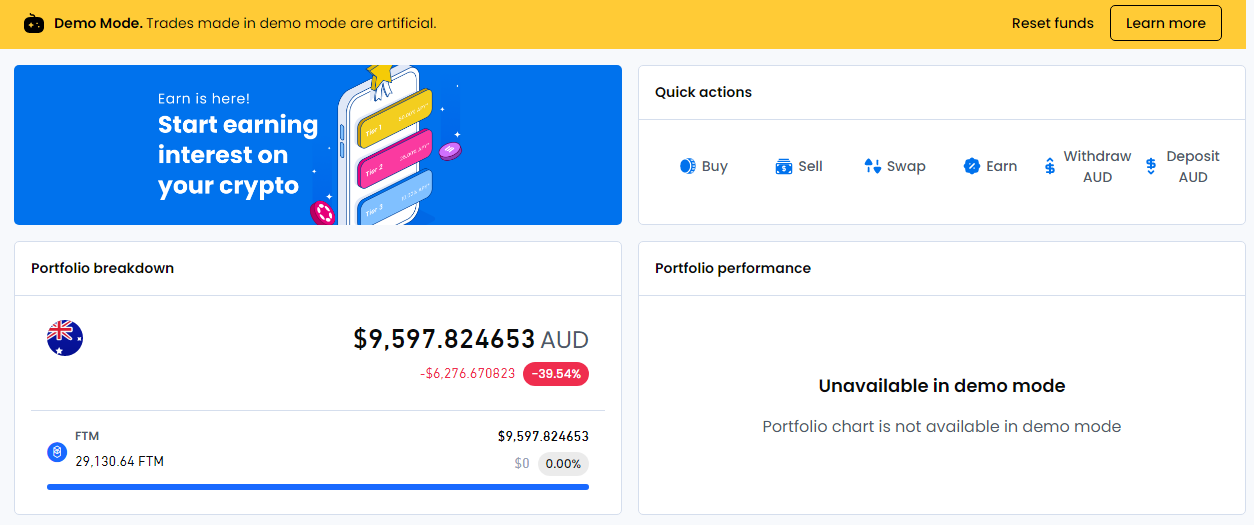

Demo mode

Demo mode is a fantastic initiative by Swyftx that allows beginners to practice trading cryptocurrency without risking any capital. Swyftx is one of few exchanges that offer crypto demo trading accounts.

Switching to demo mode will provide each account with $10,000 in “mock” currency, which can then be used to build a virtual portfolio. Demo mode is a great way for newcomers to get used to the Swyftx platform, and for experienced investors to test new trading strategies.

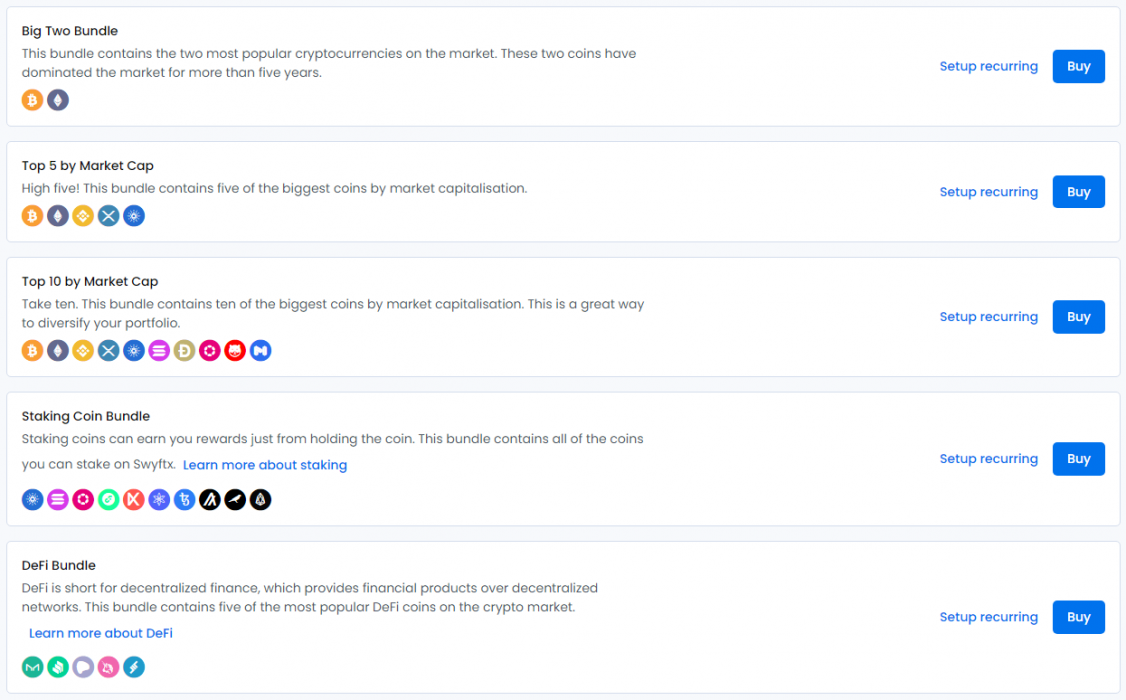

Bundles

Swyftx offers nine different crypto bundles for customers to invest in. Bundles are a bit like exchange-traded funds (ETFs), being a curated basket of multiple digital currencies. Bundles are a great way to diversify your portfolio, as they are less exposed to the price swings of a single cryptocurrency.

Bundles range from the simple “Big Two”, which contains only Bitcoin and Ethereum, to the “Staking Coin”, which is filled with ten assets that can all be staked via Swyftx Earn.

SMSF

Swyftx allows eligible Australians to add cryptocurrency to their self-managed super fund (SMSF). This has become increasingly popular due to its tax benefits and the overall performance of cryptocurrency since its inception. Swyftx has partnered with crypto SMSF specialists New Brighton Capital to meet growing demand and address any regulatory risks.

To comply with Australian policies, users must create a separate Swyftx account specifically for trading crypto within an SMSF. To be approved for this account, customers must supply supporting documentation including financial records. For a full list of SMSF requirements, refer to the ATO.

Creating an SMSF can be a convoluted and confusing process, which is why Swyftx offers consultations with their experts.

OTC

High-volume traders, institutions and SMSF accounts can buy and sell over 280+ cryptocurrencies over the counter (OTC). Swyftx’s OTC desk supports trades of over $100,000 AUD and offers global liquidity and lower fees than other Australian competitors.

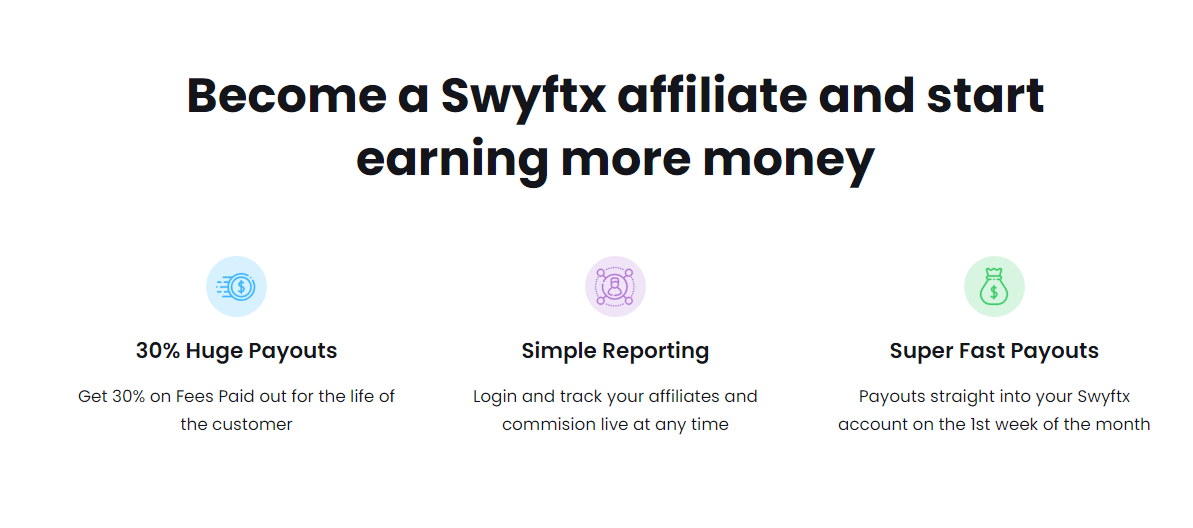

Affiliate program

Swyftx offers an affiliate program that more than 70,000 crypto investors have used. Customers with a valid Australian Business Number (ABN) will receive a commission for sharing promotional material and registering new users. Affiliates will receive 30% on all fees paid by new accounts that sign up with their unique referral link. Commissions are paid on the first week of every month.

Recurring orders

Swyftx allows its customers to automate investing through recurring orders, also known as dollar-cost averaging (DCA). DCA involves buying a certain amount of one — or multiple — cryptocurrency at regular intervals. This way, investors can ignore the short-term price fluctuations of an asset and continue accumulating.

Recurring orders are a powerful way for beginners to build a long-term crypto portfolio while mitigating the risks of trying to time the market. Swyftx customers can set up DCA orders for all 310+ supported assets, as well as crypto bundles.

Tax reports

One of Swyftx’s most compelling features is the platform’s ability to integrate with useful tax software. The Australian Tax Office (ATO) has cracked down on tax reporting for crypto investors, so Swyftx can help its customers ensure they’re meeting all their obligations.

Swyftx offers a free tax calculator. Using it is simple — customers just enter the value of disposed cryptocurrencies at the time of purchase and sale, as well as their taxable income. The calculator will then estimate the Capital Gains Tax owing come tax time.

Alternatively, Swyftx can be easily integrated with the popular tax reporting software Koinly and Crypto tax Calculator. Users can export a CSV file of their Swyftx trades for a specific timeframe and feed it into the Koinly software. That’s all there is to it — Koinly will then generate a tax report. Koinly can also connect directly to the Swyftx platform via an API key.

Business accounts

Swyftx supports business and trust accounts for professional traders and other crypto-related service providers. Personal, SMSF and entity accounts can all be linked to a single login, making cycling through them quite convenient.

Note: Users are required to create a personal account before they can open an entity account for their business or trust.

Swyftx mobile app

Swyftx offers a clean and responsive smartphone application for Android and iOS devices. The app supports most of the main features found on the desktop platform, including trading cryptocurrency on the go, receiving price notifications and transferring assets to an earn wallet.

The Swyftx mobile app has been generally well-received, with a 4.6/5 star rating and hundreds of thousands of downloads.

How to sign up to Swyftx

As one would expect from a modern, reputable exchange, signing up for a new account on Swyftx is an incredibly simple process.

Step 1

To get started, navigate to the Swyftx platform’s home page. From here, customers can select either the white “Signup” button in the top-right corner, or the large orange “Sign Up Now” button in the middle of the page.

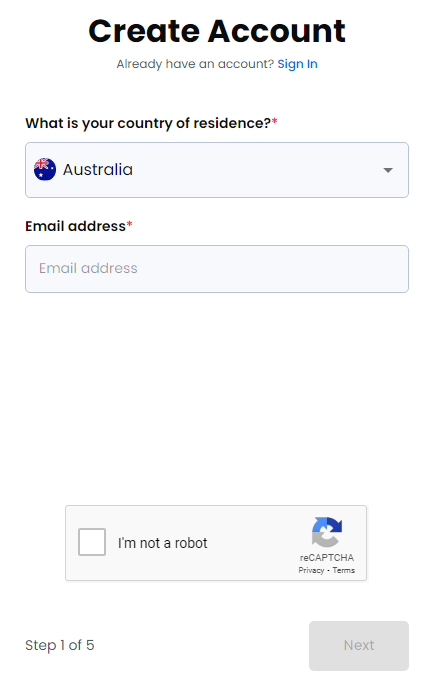

Step 2

Even if you wish to create an entity or SMSF account, you will need to start off by registering a personal account. Continue the signup process by entering your country of residence and email address. Once done, select “Next”.

Step 3

Swyftx will now send a 6-digit verification code to verify the email address entered in the previous step. Input the numbers to complete email verification.

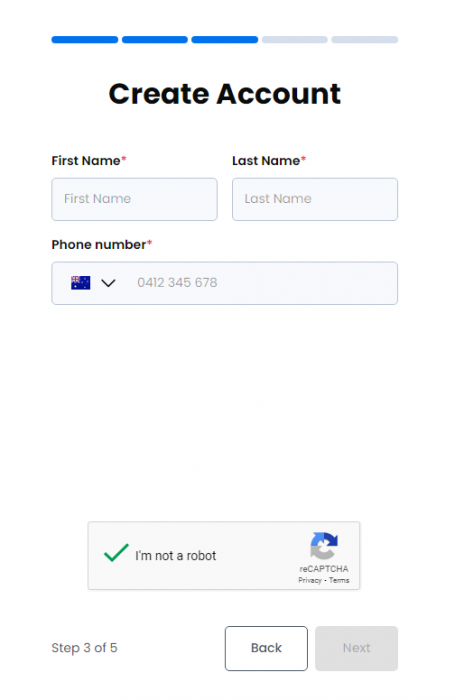

Step 4

Next, enter your first and last name, a long with a mobile number. Swyftx will then require you to enter another 6-digit code, this time verifying the mobile number provided.

Step 5

Finally, new accounts must pass Know Your Customer (KYC) verification before they can start depositing AUD and trading cryptocurrency on the Swyftx platform. This is due to the Australian government’s AML and CTF policies.

To pass this process, you must have access to some form of government-issued identification, such as a driver’s license, passport or identity card. Take a photo (using a smartphone to do this is advisable) and upload them to complete verification. Once verified, the account is registered and ready to begin trading cryptocurrencies! The verification process usually takes a couple of minutes.

Although not a requirement, it is always recommended that new accounts enable Two-Factor Authentication (2FA) before doing anything else.

Frequently asked questions

Is Swyftx legitimate?

Yes, Swyftx is a legitimate cryptocurrency exchange that was founded in 2017 and has been servicing customers since 2019. Swyftx is headquartered in Brisbane, Australia and licensed as an Australian business.

Is Swyftx safe?

Yes, Swyftx is one of the safest exchanges on the market. The platform is dedicated to protecting its user’s assets, employing industry-standard security measures such as hot/cold wallet storage, data encryption and 2FA. The exchange has never experienced a hack or other form of public attack.

Is Swyftx a wallet?

Swyftx itself is not a wallet, however, the exchange does support storing over 310 cryptocurrencies on the platform. Additionally, Swyftx supports 15+ Earn wallets for customers to passively earn income on assets like Tron, Cardano and Ethereum. Although Swyftx’s wallets are safe, it is typically recommended to withdraw cryptocurrencies from exchange wallets to a third-party hardware wallet.

Can Swyftx be trusted?

Yes, Swyftx is one of the more reputable exchanges available to Australian investors. The company has an Australian-based support and development team and is registered with the relevant government agencies. Additionally, Swyftx has garnered impressive ratings of 4.5+ on Australian review websites such as TrustPilot and ProductReview.

Is Swyftx regulated?

Yes, Swyftx is registered with and regulated by the Australian Transaction Reports and Analysis Centre (AUSTRAC). It is advised that crypto beginners stick to regulated exchanges, making Swyftx a solid option.