Dune Analytics has released data that illustrates the true revenue-earning potential of NFTs for prominent lifestyle labels, with Nike and Gucci alone reportedly raking in approximately US$260 million in sales between them.

Fashion and leisure brands Dolce & Gabbana, Adidas, Tiffany, Nike and Gucci are reportedly reaping the rewards of their NFT seeds, following the release of new NFT revenue data showing the total NFT revenue for 13 companies. Nike sits at the top of the board with a whopping US$185 million:

According to the data, Nike has generated almost US$1.3 billion in transaction volume from secondary NFT trading, which adds to its primary sales (US$93 million) and generated royalties ($92 million). Nike has more than 14 collections under its belt that are working to generate these funds, with a significant portion of these (such as CloneX) attributed to the company’s recent acquisition of RTFKT. This has enabled Nike to make 6,362 ETH in the past month alone, despite the crypto winter.

While many of the companies on this list seek to purely optimise ‘revenue per user’ through NFT drops and merchandise, others are using NFTs as an opportunity to establish deeper connections with their fans. Regardless of the motivation behind corporate involvement, the proof is in the pudding when it comes to the ongoing influence NFTs have on profits.

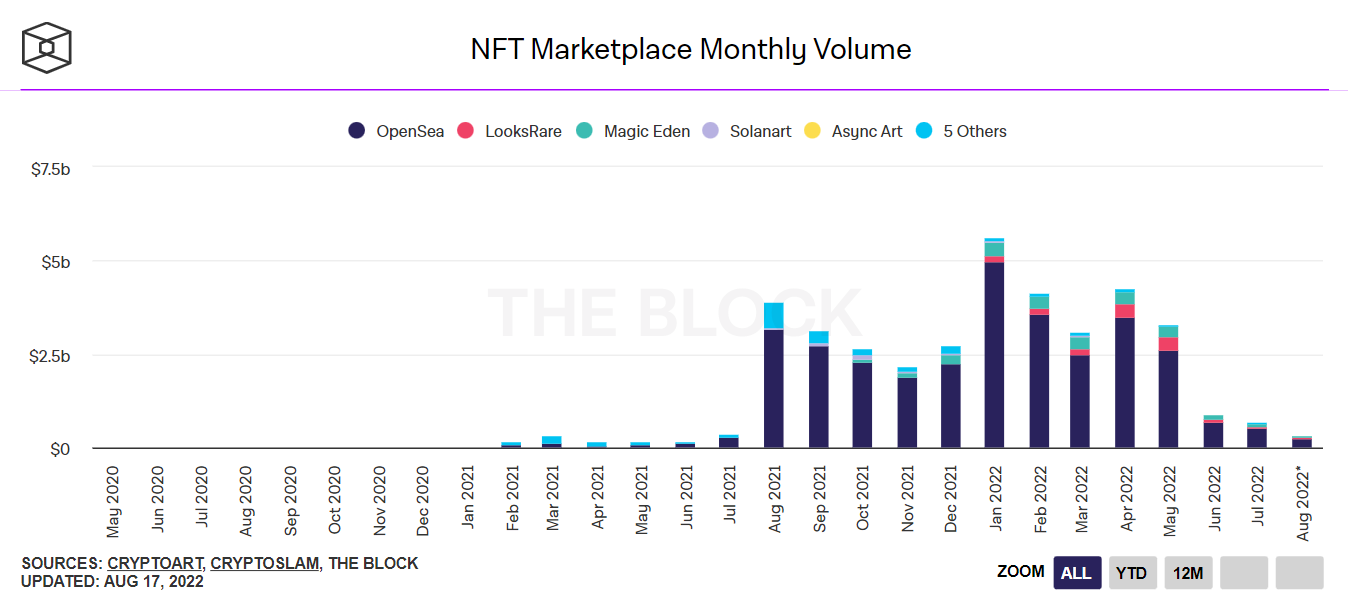

Almost $3B Spent on Minting in 2022

Not only has an extreme amount of money been spent on the purchase of NFTs, but also on the minting of them. A recent report from blockchain analytics platform Nansen found that NFT fans have spent US$2.7 billion solely on the minting of art in 2022 so far. The findings were based on product activity from over 1 million unique wallet addresses.

However, just a week ago a lengthy list of celebrities found themselves in hot water with US consumer watchdog group Truth in Advertising. The group sent warning letters to 19 celebrities, including socialite Paris Hilton and pop star Justin Bieber, regarding the alleged shilling of NFTs via social media.